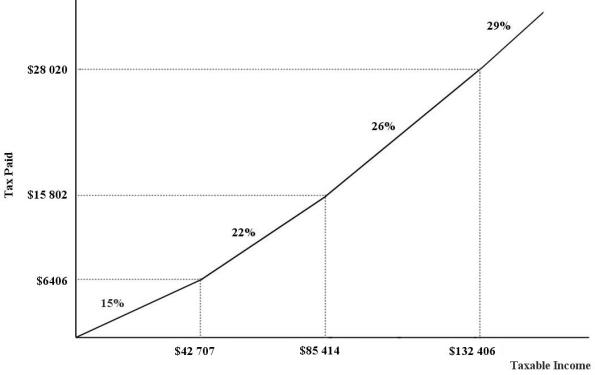

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.This income-tax system can be characterized as

Definitions:

Dispose of Cars

The process of disposing or getting rid of cars that are no longer wanted, which can include selling, recycling, or scrapping them.

Average Variable Costs

The total variable costs (costs that change with production volume) divided by the total output.

Repairs

The process of fixing or restoring something that is broken or damaged to bring it back to a good condition.

Hydraulic Car Smasher

A machine used in scrapyards to crush cars into small, compact pieces using hydraulic power.

Q2: Consider the net tax rate,denoted by t.Which

Q7: Refer to Figure 17-6.Firms X and Y

Q19: Refer to Table 13-2.Suppose the firm is

Q22: If nominal national income increased by 10%

Q31: The change in desired consumption divided by

Q59: The two main competing goals in the

Q66: Consider a simple macro model with a

Q69: Suppose that the marginal propensity to consume

Q91: Refer to Table 13-3.The marginal product of

Q97: In the short run,the aggregate supply curve