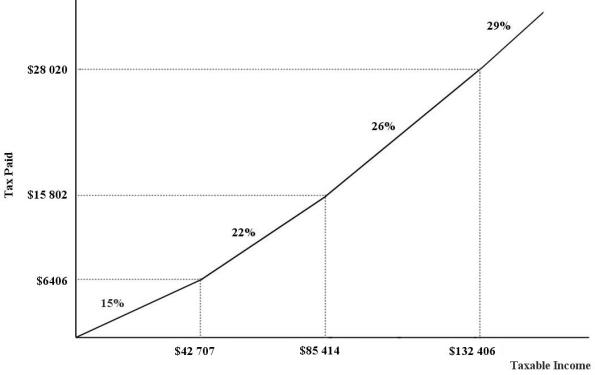

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What must be true of the four marginal income-tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Toxic Shock Syndrome

A rare, life-threatening complication of certain types of bacterial infections, often associated with tampon use.

Staphylococcus Aureus

A type of bacteria commonly found on the skin and in the nose, which can cause a range of infections, from minor skin conditions to serious bloodstream infections.

Gallbladder Attack

A painful condition often resulting from the blockage of bile flow, leading to inflammation and gallstone complications.

Bacterial Meningitis

A severe infection of the protective membranes covering the brain and spinal cord, typically caused by bacteria, leading to potentially life-threatening inflammation.

Q8: The economyʹs aggregate supply (AS)curve is assumed

Q12: Consider a small economy with 3 individuals

Q29: The Canada (and Quebec)Pension Plans (CPP and

Q30: A paper mill discharges chemicals into a

Q41: Suppose market E discriminates against one group

Q47: Consider a consumption function in a simple

Q50: Refer to Table 13-1.The total revenue of

Q53: The percentage of disposable income that is

Q77: Suppose actual output is less than potential

Q106: When the marginal costs of pollution abatement