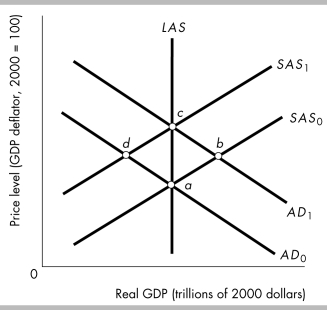

-In the above figure, if the economy is initially at point a, the short- run effect of a cut in the federal funds rate is given by movement from point

Definitions:

Standard Deviation

A measure of the dispersion or variability of a set of data points around the mean, commonly used in finance to represent the volatility or risk associated with a particular investment.

Expected Return

A measure of the average likely profit or loss on an investment considering past performance or future forecasts.

Beta

A measure of a stock's volatility in relation to the overall market; a higher beta means higher risk but potentially higher returns.

Business-Specific Risk

The risk associated with the particular operations, industry, or market of a specific company, apart from the general market risks.

Q9: An advantage of automatic stabilizers over discretionary

Q23: If the Federal Reserve purchases government securities,<br>A)

Q67: The United States can use all of

Q71: The government begins year 1 with $25

Q105: Prior to the Great Depression, the purpose

Q134: "The Fed can affect aggregate demand through

Q161: Which of the following reasons explains why

Q225: A demand- pull inflation can be described

Q280: In the above figure, which of the

Q408: "Allocative efficiency in the production of cherries