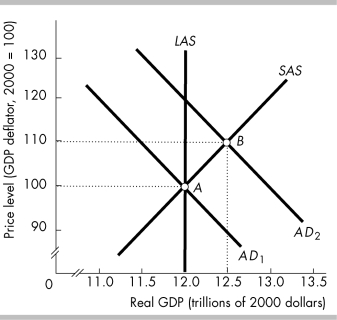

-In the above figure, the shift from AD1 to AD2 might have been the result of

Definitions:

Uncovered Call

An uncovered call is an options strategy where the seller sells call options without owning the underlying securities, exposing the seller to unlimited risk.

Strike Price

The price at which a derivative contract can be exercised, specifically referring to the price at which the holder of an option can buy (call option) or sell (put option) the underlying asset.

Listed Options

Contracts traded on a stock exchange that give buyers the right, but not the obligation, to buy or sell a security at a specified price within a certain time period.

Post Margins

The practice of depositing collateral to cover potential losses in trading accounts, especially in futures and options markets.

Q8: When the New York Jets pay their

Q79: Moving upward along the SAS results in

Q177: Studying the effects choices have on the

Q179: Which of the following is NOT a

Q198: In the above figure, B is the

Q208: In the short- run, real GDP can

Q291: If you have $5,000 in wealth and

Q371: If the money prices of resources changes,<br>A)

Q384: If the change in autonomous investment equals

Q475: A normative statement concerns<br>A) a value judgment.<br>B)