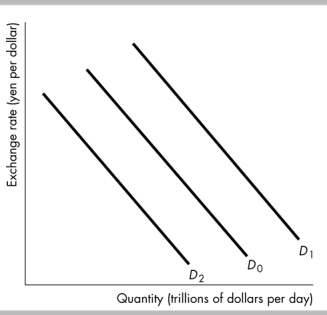

-In the figure above, the shift in the demand curve for U.S. dollars from D0 to D1 could occur when

Definitions:

Face Value

The nominal value printed on a bond or security, representing the amount due at maturity.

Stated Interest Rate

The annual interest rate declared on a financial instrument, such as a loan or bond, not necessarily reflecting fees or compounding.

Market Rate

The prevailing interest rate available in the marketplace on investments, loans, and deposits, determined by supply and demand factors.

Discount on Bonds Payable

The amount by which a bond's selling price is less than its face value.

Q32: Which of the following examples definitely illustrates

Q39: Explain why both rich and poor people

Q172: Suppose that U.S. inflation is 3 percent

Q330: If the target exchange rate is 100

Q335: Suppose that a dollar buys 120 yen.

Q439: Using the data in the above table,

Q443: For the Jones household it has been

Q468: If imports are $1,200 billion and exports

Q605: The above table gives data on two

Q617: "OPEC should supply more oil so that