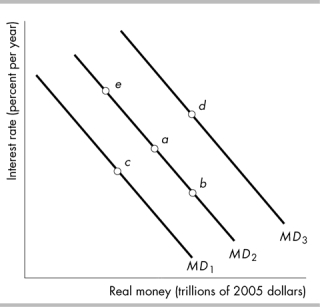

-In the above figure, suppose the economy is at point a. If there is an increase in real GDP, there is a movement to point such as

Definitions:

Marginal Tax Rates

The rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your next dollar of taxable income.

Interest Income

Revenue earned from investments in interest-bearing financial instruments, such as bonds, savings accounts, or loans.

Eligible Dividends

Dividends that are qualified for special tax treatment under certain jurisdictions.

Tax Paid

The amount of money paid to the government as a result of taxable activities, such as income earned or goods sold.

Q10: The price of a computer in the

Q49: What are the main components of the

Q92: In 2008, Armenia had a real GDP

Q122: According to the Ricardo-Barro effect, government deficits<br>A)

Q172: The inflation rate in Venezuela has increased

Q176: In the absence of the Ricardo-Barro effect,

Q213: In September 2008, Regions Bank has $89

Q343: ʺIn the foreign exchange market, if the

Q392: The Federal Reserve has _ regional Federal

Q411: The minimum percentage of deposits that a