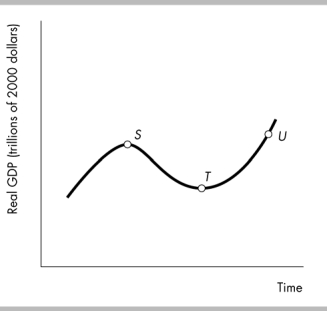

-In the above figure, the distance between points T and U represents

Definitions:

Yield Curve

A graph showing the relationship between interest rates and the maturity of different bonds of similar credit quality, indicating the term structure of interest rates.

Coupon Bonds

Are bonds that pay the holder a fixed interest rate (the coupon) over a specified period, culminating in the return of the bond's face value on the maturity date.

Zero-Coupon Bond

A type of bond that is issued at a discount and does not pay periodic interest payments, only the face value at maturity.

Forward Interest Rate

An interest rate agreed upon now for a loan that will start at a future date, often indicative of market expectations for future interest rates.

Q13: A relative price is the<br>A) difference between

Q144: Using the above figure, during which month

Q173: The chain-weighted output index method of measuring

Q217: List the components of the expenditure approach

Q290: Doctors find that one aspirin per day

Q300: Which of the following is TRUE regarding

Q324: The nationʹs structural unemployment will increase when<br>A)

Q386: GDP using the expenditure approach equals the

Q388: According to the article, the best

Q398: If the CPI was 122.3 at the