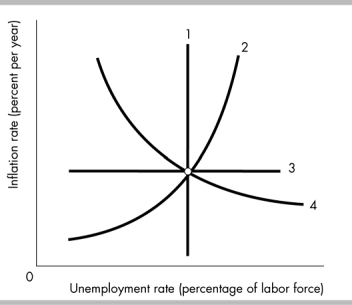

-In the above figure, which of the following curves represents the long -run Phillips curve?

Definitions:

Beta Coefficient

The beta coefficient measures the volatility of an investment or portfolio relative to the volatility of the overall market; it's a key metric in the Capital Asset Pricing Model (CAPM).

Market

An economic concept that describes the aggregate of possible buyers and sellers of a given good or service, along with the transactions between them.

Marginal Investor's Risk Aversion

A concept that describes the level of additional risk an investor is willing to take for a marginal increase in potential return.

SML

Stands for the Security Market Line, representing the expected return of investments as a function of their non-diversifiable risk.

Q44: A decrease in the expected inflation rate

Q67: Discretionary policy requires an act of Congress.

Q179: What are criticisms of the real business

Q182: If Samantha predicts future inflation based on

Q197: The marginal propensity to consume is equal

Q274: By itself, an increase in aggregate demand

Q283: In the above, which figure shows the

Q304: Oil prices increase sharply, raising the price

Q307: The _cycle theory states that only unexpected

Q312: What is the Phillips curve? Discuss both