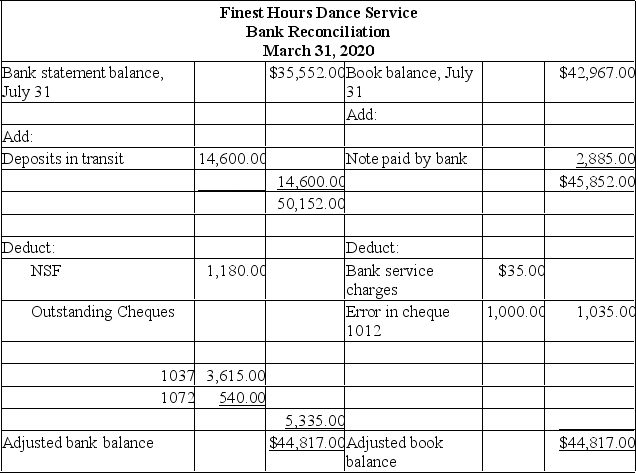

You are a supervisor in the accounting department of Finest Hours Consulting. The person you just hired shows you the bank reconciliation prepared for March 31, as shown below.

In comparing the bank reconciliation to the Cash account in the General Ledger, you notice a problem. You investigate further and come up with some additional information as follows:

In comparing the bank reconciliation to the Cash account in the General Ledger, you notice a problem. You investigate further and come up with some additional information as follows:

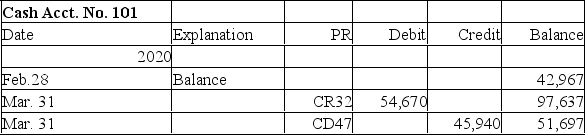

a. The Cash account in the General Ledger showed the following:

b. The deposit in transit represerts the February 28 deposit that cleared the bank or March 1.

b. The deposit in transit represerts the February 28 deposit that cleared the bank or March 1.

c. The $1,000 error deducted from the book balarce is from cheque #1012, for Office Equipment that was correctly drawn by the bank for but was recorded incorectly in the cash disbursements journal as .

d. The bank paid a note on our behalf; principal, interest of , plus a service charge of . There were no other notes collected or paid by the bank in March.

e. The deposit of March 31 does not appear on the bank statement. Instructions:

Prepare a corrected bank reconciliation for March 31, 2020.

Definitions:

Liable

Legally responsible or obligated to something, especially to make restitution or compensation.

Secured Party

An individual or organization holding an interest in a debtor's property as collateral for a loan.

Confirmation

The process of verifying or validating an arrangement or transaction, often documented in writing.

Secured Transaction

A financial agreement in which property is pledged as collateral for a loan, granting the lender rights to the property if the borrower defaults.

Q7: Internal control devices for banking activities include

Q65: In a periodic inventory system, cost of

Q72: Accounts receivable arise from credit sales to

Q81: First Shot Photography Store has the following

Q90: The formula for calculating straight-line depreciation is<br>A)

Q94: The matching principle requires that accrued interest

Q121: The first five steps in the accounting

Q129: The principle of faithful representation is used

Q146: The inventory cost flow assumption that assigns

Q151: Depreciation is the process of allocating the