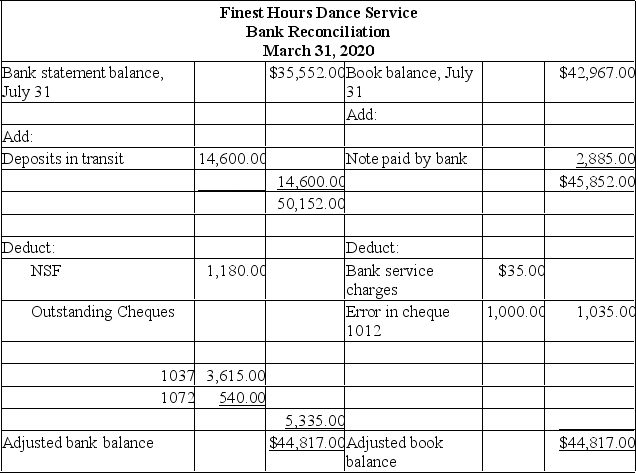

You are a supervisor in the accounting department of Finest Hours Consulting. The person you just hired shows you the bank reconciliation prepared for March 31, as shown below.

In comparing the bank reconciliation to the Cash account in the General Ledger, you notice a problem. You investigate further and come up with some additional information as follows:

In comparing the bank reconciliation to the Cash account in the General Ledger, you notice a problem. You investigate further and come up with some additional information as follows:

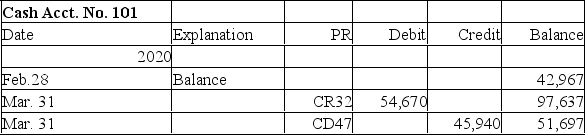

a. The Cash account in the General Ledger showed the following:

b. The deposit in transit represerts the February 28 deposit that cleared the bank or March 1.

b. The deposit in transit represerts the February 28 deposit that cleared the bank or March 1.

c. The $1,000 error deducted from the book balarce is from cheque #1012, for Office Equipment that was correctly drawn by the bank for but was recorded incorectly in the cash disbursements journal as .

d. The bank paid a note on our behalf; principal, interest of , plus a service charge of . There were no other notes collected or paid by the bank in March.

e. The deposit of March 31 does not appear on the bank statement. Instructions:

Prepare a corrected bank reconciliation for March 31, 2020.

Definitions:

Prior Service Credit

A pension plan feature that grants employees credit for service periods before the commencement of the pension plan, affecting their benefits.

Defined Benefit Pension Plan

A retirement plan where the benefits that an employee will receive upon retirement are defined based on a formula considering factors such as salary history and duration of employment.

Service Cost

The portion of the pension expense that is recognized for the increase in pension benefits related to employee services of the current period.

Unrecognized Prior Service Cost

Costs not immediately recognized on the income statement related to retroactive benefits granted to employees in a pension plan amendment.

Q8: Obsolescence<br>A) Occurs when an asset is at

Q21: TechCom has $40,000 in outstanding accounts receivable.

Q25: What is triangulation in research? Make up

Q29: On January 1, 2020, Bailey Company purchased

Q29: Managers place a high priority on internal

Q34: The percentage of sales approach for estimating

Q35: The straight-line method and the double-declining-balance method

Q66: A patent<br>A) Gives the owner the exclusive

Q97: How would you answer the question "Are

Q109: Danner Co. purchased a computer on