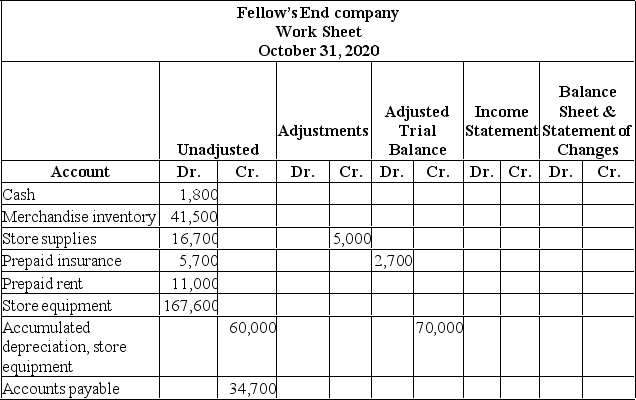

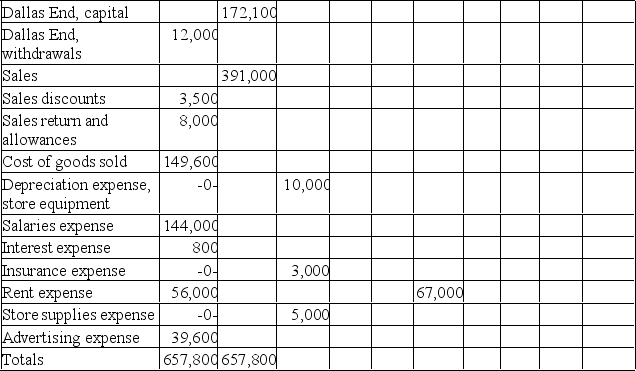

Complete the work sheet for the year ended October 31, 2020.

Definitions:

Excise Tax

An excise tax is a tax imposed on the sale of specific goods and services, such as tobacco, alcohol, and gasoline, often levied at the time of purchase.

Demand Curves

Graphical representations showing the relationship between the price of a good and the quantity demanded.

Supply Curves

Supply curves graphically represent the relationship between the price of a good or service and the quantity of it that suppliers are willing to produce and sell.

Equilibrium Quantity

The quantity at which the intentions of buyers and sellers in a particular market match at a particular price such that the quantity demanded and the quantity supplied are equal; the profit-maximizing output of a firm.

Q16: The Income Summary account is<br>A) The account

Q46: Evaluate each inventory error and determine

Q57: Step Two of the accounting cycle requires

Q60: Businesses normally get a full credit for

Q74: Using the schedule below, indicate the impact

Q88: Adjusting entries are required to match revenues

Q117: Reversing entries<br>A) Are optional<br>B) Are mandatory<br>C) Fix

Q119: A post-closing trial balance shows<br>A) All ledger

Q134: A business paid $100 to Karen Smith

Q200: Gallery Corp. performs 20 days' work on