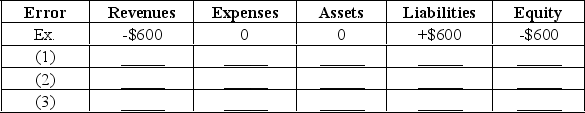

Given the schedule below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect.(1) Recorded accrued salaries expense of $1,200 with a debit to Prepaid Salaries.(2) The bookkeeper forgot to record $2,700 of depreciation on office equipment.(3) Failed to accrue $300 of interest on a note receivable. Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

Definitions:

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns to ensure a company's bookkeeping system is mathematically correct.

Journalizing

The process of recording financial transactions in a journal or diary, marking the first step in the accounting cycle.

General Journal

A general journal is a fundamental accounting record where all day-to-day financial transactions of a business are initially recorded.

Ledger Accounts

Financial records within a ledger that summarize the transactions related to a company's assets, liabilities, equity, revenues, and expenses.

Q5: The General Ledger system represents the primary

Q13: The following transactions were completed by Augsburg

Q36: A journal entry with a debit to

Q56: A $15 credit to Sales was posted

Q59: Calculate the gross profit ratio for the

Q64: Asset, liability and revenue accounts are not

Q69: Explain how inventory management is evaluated using

Q94: One difference in the Sales Journal between

Q123: Given the following partial income statement information

Q198: Prepare a classified balance sheet at December