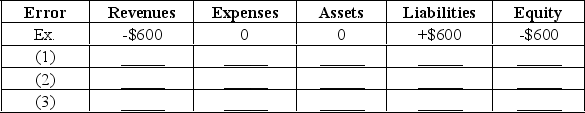

Given the schedule below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect.(1) Recorded accrued salaries expense of $1,200 with a debit to Prepaid Salaries.(2) The bookkeeper forgot to record $2,700 of depreciation on office equipment.(3) Failed to accrue $300 of interest on a note receivable. Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

Definitions:

Q16: List the steps in the accounting cycle.

Q18: During January, a company that uses

Q24: The difference between a company's assets and

Q37: Each transaction recorded in the Sales Journal

Q64: The accounting equation is the link between

Q93: The bookkeeper of the Tide Company prepared

Q100: Which of the following statements is incorrect?<br>A)

Q106: Current liabilities include accounts receivable, unearned revenues,

Q116: The merchandise turnover ratio<br>A) Is cost of

Q159: Properties or economic resources owned by a