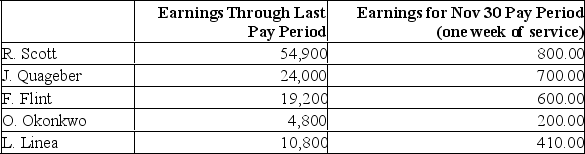

Spieth Company employees had the following earnings records at the close of the November 30 payroll period.

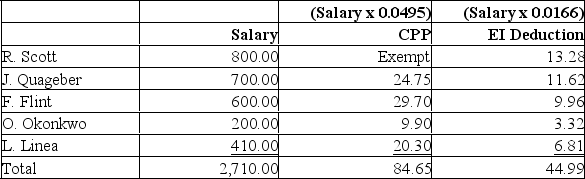

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Spieth Company's payroll taxes expense for each employee include: 4.95% CPP on the annual pensionable earnings 50,100 ($55,900 maximum with the first $3,500 exempt), and 1.4 times the employees EI rate of 1.66% paid to a maximum of $51,700 annually. As well, $300 in federal and provincial income taxes will be deducted from the employees' gross pay for the week. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.

Note that R. Scott would have already paid the maximum CPP and EI for the year

Note that R. Scott would have already paid the maximum CPP and EI for the year

Definitions:

Sigmund Freud

An Austrian neurologist and the founder of psychoanalysis, a clinical method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Stuttering

A speech disorder characterized by repeated or prolonged sounds, syllables, or words, disrupting the normal flow of speech.

Transference

In psychoanalysis, the patient’s transfer to the analyst of emotions linked with other relationships (such as love or hatred for a parent).

Psychological Conflicts

Inner struggles resulting from the clash of opposing needs, desires, or emotions.

Q29: If the governmentʹs tax revenues are less

Q40: Posting is the process of copying the

Q53: Small Company's 16 sales personnel earned total

Q63: The governmentʹs primary budget deficit or surplus)

Q64: The accounting equation is the link between

Q126: Suppose the Bank of Canada raises its

Q138: What is the statement of financial position?

Q167: Which of the following items does not

Q191: Internal controls include procedures to protect assets

Q196: Ownership of a corporation is divided into