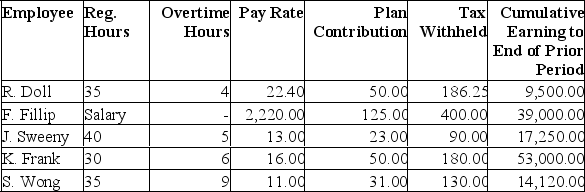

Williams Inc. has collected payroll data for the most recent weekly pay period.

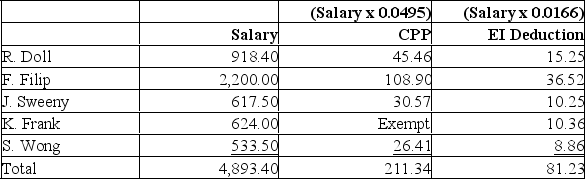

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

F.Fillip is an administrative employee, and the other employees are shop workers. Employees are paid time and a half for any overtime work. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.(c) The employees' fringe benefits.

*Note that K.Frank would have already paid the maximum CPP and EI for the year.

Definitions:

Corporate Tax Rate

The proportion of a company's profits that is owed to the government as tax.

Fixed Costs

Costs that do not change with the level of production or sales, such as rent, salaries, and loan payments.

Operating Leverage

A measure of how sensitive a company's operating income is to changes in revenue, indicating the degree of fixed versus variable costs.

Q6: A payment from a proprietorship or partnership

Q28: Dave Shurek started Hindsight Electric in February

Q45: Your neighbor runs a retail business and

Q49: A tax levied on the amount of

Q99: The process of copying journal information to

Q101: A country that engages in no foreign

Q107: If a basket of goods costs 1000

Q121: Explain the difference between a business transaction

Q196: Ownership of a corporation is divided into

Q207: External users of accounting information include<br>A) shareholders<br>B)