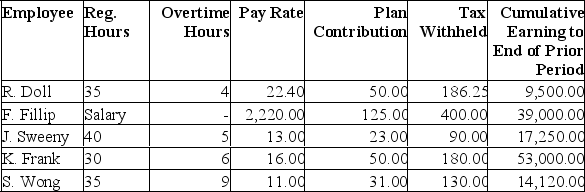

Williams Inc. has collected payroll data for the most recent weekly pay period.

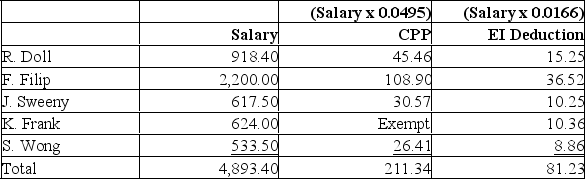

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

F.Fillip is an administrative employee, and the other employees are shop workers. Employees are paid time and a half for any overtime work. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.(c) The employees' fringe benefits.

*Note that K.Frank would have already paid the maximum CPP and EI for the year.

Definitions:

Chronic

Describing something, especially a disease or condition, persisting for a long time or constantly recurring.

Workplace Risk Factors

Elements in a work environment that can contribute to physical or mental health problems among employees.

CDC

The Centers for Disease Control and Prevention, a national public health institute in the United States responsible for controlling and preventing disease, injury, and disability.

Working Late

The action of staying at one's workplace beyond the usual or scheduled time for departure, often to complete tasks or meet deadlines.

Q14: Refer to Figure 32-3. Starting from point

Q24: After posting the entries to record salary

Q59: To account for vacation pay, employers should

Q74: If a tariff is imposed by a

Q91: Under the perpetual system, special journals are

Q100: Define controlling accounts. In what ledger do

Q101: A country that engages in no foreign

Q103: According to the infant-industry argument for trade

Q114: When a government changes its fiscal policy,

Q166: An individual or organization that owes an