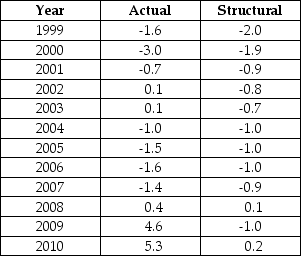

The data below provides the Actual and Structural Budget Deficits,as a percentage of real GDP,for Canada between 1999 and 2010.Note that a negative value in the table indicates a budget surplus.

TABLE 31-2

TABLE 31-2

-Refer to Table 31-2.Based on the data in the table,in which of the following years was output greater than potential?

Definitions:

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, placing a larger burden on those who have higher earnings.

Average Tax Rate

The proportion of the total taxable income paid in taxes, calculated by dividing the total tax amount by the total income.

Regressive Tax

A tax system where the tax rate decreases as the amount subject to taxation increases, often placing a heavier burden on lower-income individuals.

Higher Incomes

Levels of earnings that exceed the average or median income for a particular region or demographic.

Q17: Other things being equal, an appreciation of

Q41: Refer to Table 32-1. Country A has

Q43: If the Bank of Canada chooses to

Q56: Consider the process of disinflation. Typical estimates

Q74: Refer to Figure 27-3. The increase in

Q82: One reason that economists are interested in

Q89: If we observe that the bank rate

Q89: Two nations want to engage in trade

Q106: A good example of an outcome that

Q145: Refer to Figure 34-5. Assume Canada has