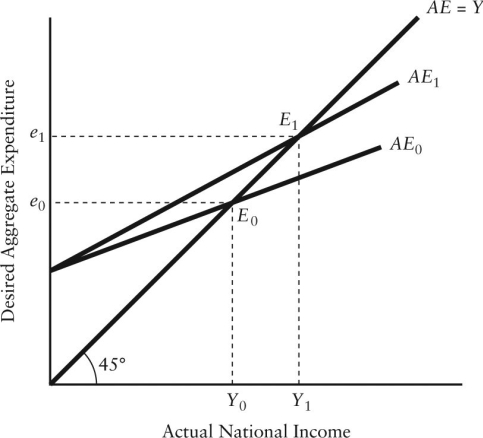

FIGURE 22-4

FIGURE 22-4

-Refer to Figure 22-4. The rotation from AE0 to AE1 implies that the marginal propensity to spend and the value of the simple multiplier .

Definitions:

Double Declining-Balance Depreciation

An accelerated depreciation method that doubles the rate of straight line depreciation.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption or loss of value.

Declining Balance Depreciation

A depreciation method that applies a constant rate to the declining book value of an asset, resulting in accelerated depreciation.

Straight-Line Rate

A method of calculating depreciation or amortization by evenly spreading the cost of an asset over its useful life.

Q2: Tax and other revenues collected by all

Q5: If a countryʹs labour force is 15

Q24: Refer to Figure 18-2. This income-tax system

Q28: Consider the basic AD/AS model. If major

Q29: A parallel upward shift in the net

Q51: When macroeconomists use the term ʺrecessionʺ they

Q80: Consider the basic AD/AS macro model. A

Q83: Compared to Neoclassical growth theory, newer ʺendogenous

Q112: What economists sometimes call the ʺlong-run aggregate

Q118: Suppose taxes are levied in the following