Multiple Choice

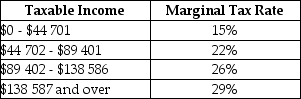

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the portion of earnings taxed at the maximum rate of 29%?

Recognize the value and applications of program evaluation in social reforms.

Understand how scientific research contributes to explanations and predictions in behavior.

Understand the concept and implications of price elasticity of demand.

Differentiate between short-run and long-run elasticity of supply.

Definitions:

Related Questions

Q6: In a simple macro model with a

Q11: Suppose aggregate output is demand-determined. Suppose a

Q14: Which of the following statements about a

Q41: The ʺvalue addedʺ for an individual firm

Q54: Between 1995 and 2011, Canadaʹs greenhouse gas

Q66: Statistics Canada excludes from GDP the value

Q69: If the government wants to ensure that

Q74: Consider the simplest macro model with demand-determined

Q93: The Canadian exchange rate is defined to

Q120: Consider the simplest macro model with demand-determined