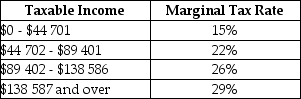

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 26%?

Definitions:

Workers Equally Well Suited

A situation in which workers possess the same skills and abilities, making them interchangeable in their roles without affecting productivity.

Structural Unemployment

A form of unemployment caused by a mismatch between the skills that workers in the economy can offer and the skills demanded by employers.

Supply And Demand Equilibrium

The point at which the quantity of a product demanded by consumers equals the quantity supplied by producers.

Frictional Unemployment

This refers to unemployment that occurs when people are between jobs or are entering the workforce for the first time.

Q18: Refer to Table 13-3. The increase in

Q22: In national-income accounting, ʺdepreciationʺ refers to<br>A) a

Q22: Refer to Figure 16-2. Suppose that the

Q25: Refer to Table 20-5. The real GDP

Q28: If a union succeeds in shifting the

Q29: What is the approximate measure 2014 data)

Q37: Fiscal policy involves the governmentʹs use of

Q42: Consider an income-tax system that requires all

Q46: Refer to Figure 16-4. Once some quantity

Q76: Suppose a firm producing roof shingles imposes