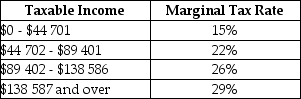

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much total federal tax would be due?

Definitions:

Competition

The rivalry among sellers trying to achieve such goals as increasing profits, market share, and sales volume by varying the elements of the marketing mix.

Independently Acting Buyers

are consumers who make purchasing decisions based on their own preferences and circumstances, without coordinating with others.

Freedom to Enter

The condition in a market where new firms can enter the industry without facing prohibitive barriers or regulations.

Opportunity Costs

The cost of forgoing the next best alternative when making a decision or choosing between options.

Q4: In the study of short-run fluctuations in

Q42: In an open economy with government and

Q43: Statistics Canada defines the poverty line as

Q45: Refer to Table 20-7. The growth rate

Q66: Statistics Canada excludes from GDP the value

Q77: Refer to Table 20-8. The implicit GDP

Q99: Which of the following statements concerning cost-benefit

Q99: Consider the following news headline: ʺIncrease in

Q118: Refer to Figure 16-4. Suppose the optimal

Q138: Consider a simple macro model with a