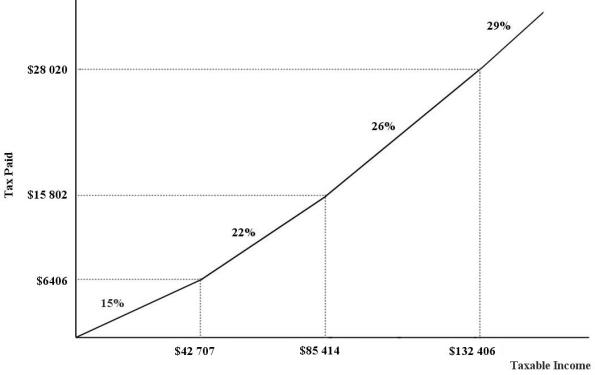

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

Definitions:

Weighted-Average Method

This method computes the cost of goods sold and the value of ending inventory by taking the mean cost of every unit available for sale throughout the period.

Cost Reconciliation

The process of analyzing and adjusting differences between actual costs and standard or budgeted costs.

Process Costing

An accounting method typically used in manufacturing, where costs are assigned to batches or processes, useful for products that are indistinguishable from each other.

Conversion Costs

The sum of direct labor and manufacturing overhead costs, representing the costs to convert raw materials into finished goods.

Q3: Economic losses in an industry are a

Q8: Refer to Figure 17-8, which depicts the

Q12: The two main competing goals in the

Q75: Refer to Figure 17-4. The optimal amount

Q76: During the 1970s, Canada experienced an unusual

Q77: Suppose that the professional association of dentists

Q85: Economists expect some unemployment to exist even

Q96: In the simple macroeconomic model, ʺautonomous expendituresʺ

Q123: Refer to Figure 21-1. The APC will

Q152: Other things being equal, higher real interest