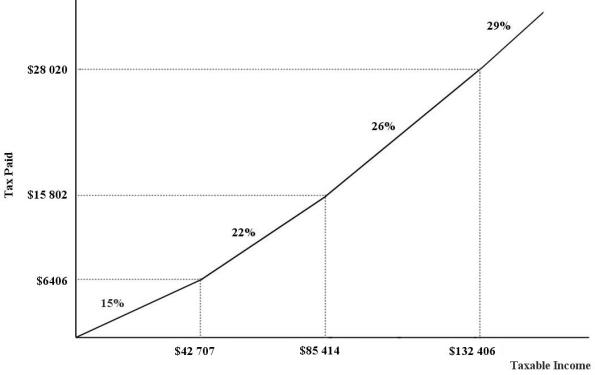

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $98 125 will pay $________ in income taxes.

Definitions:

Disposable Income

The amount of money a household has available for spending and saving after income taxes have been accounted for.

Consumption Function

A macroeconomic concept that describes the relationship between total consumption and gross national income.

Consumption Function

An economic formula that represents the relationship between total consumer spending and total national income.

Household Wealth

The total value of all financial and non-financial assets owned by members of a household minus any liabilities.

Q11: The socially optimal level of output of

Q13: Refer to Table 19-1. In which years

Q17: Refer to Figure 17-3. What area on

Q36: For any firm in any market structure,

Q51: The union wage premium refers to the<br>A)

Q58: An example of a rivalrous good is<br>A)

Q65: Consider the allocation of a nationʹs resources

Q93: Refer to Table 13-2. The marginal product

Q102: Refer to Table 20-3. What is the

Q111: An example of a regressive tax in