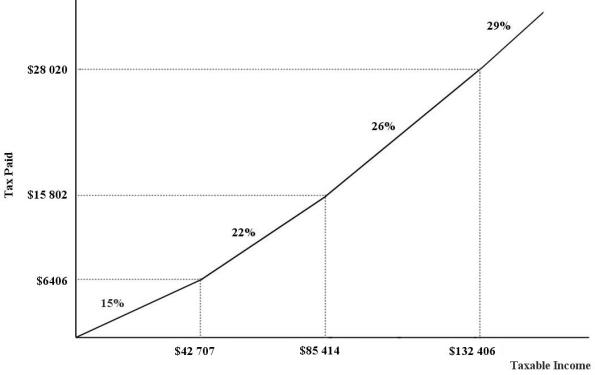

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What must be true of the four marginal income-tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Nasal Disease

A medical condition affecting the nose, which can range from common colds to allergies and more serious conditions like sinusitis.

Videonystagmograph

A diagnostic tool used to assess and record involuntary movements of the eyes (nystagmus) to evaluate balance and dizziness disorders.

Balance

The state of having equal distribution of weight or amount, or the ability to maintain equilibrium.

Evaluates

The process of assessing or examining something to determine its value, quality, or importance.

Q11: Consider the investment component of GDP. The

Q13: Refer to Table 13-4. Which of the

Q18: Why are direct controls for reducing pollution

Q22: An efficiency argument for public provision of

Q49: When calculating GDP from the expenditure side,

Q58: Consider the following equation:<br>GHG = GHG ×

Q94: Suppose a Canadian firm imports $5000 worth

Q114: For firms or individual households, desired expenditure

Q114: Economists generally view pollution as<br>A) an economic

Q118: Refer to Figure 16-4. Suppose the optimal