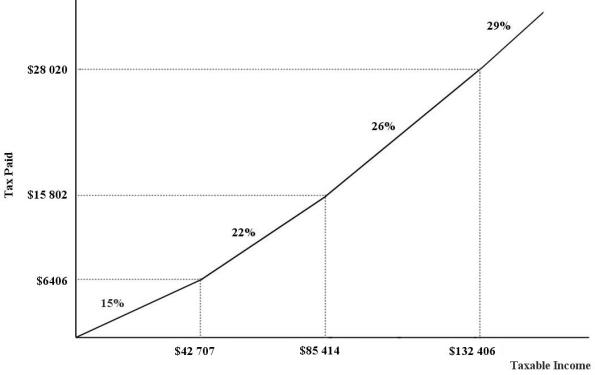

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What needs to be true about the four marginal income-tax rates in order for this tax system to be considered regressive?

Definitions:

Inflation

The rate at which the comprehensive cost of goods and services inflates, sapping the buying power.

Total Percentage Return

The total return on an investment, including both capital gains and dividends, expressed as a percentage of the initial investment.

Dividends

Distributions of earnings from a corporation to its owners, sharing a part of the company's income.

Shares

Equity shares in a corporation or financial asset, offering stakeholders a balanced share in the declared profits through dividends.

Q24: Since 1960, in Canada the price level

Q31: In Canada, taxes are levied and collected

Q37: A pollution-control policy that, in principle, can

Q74: Refer to Figure 16-4. Suppose the government

Q81: The marginal propensity to save refers to

Q85: Suppose the last unit of a factor

Q99: The main advantage of using market-based schemes

Q100: Suppose the price level is constant, output

Q102: In macroeconomics, the term ʺnational incomeʺ refers

Q111: Suppose a firm producing roof shingles imposes