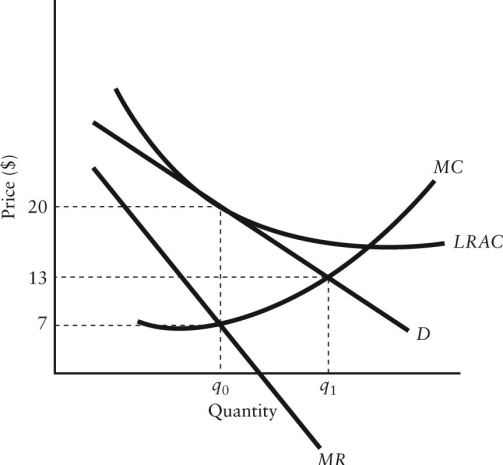

The diagram below shows selected cost and revenue curves for a firm in a monopolistically competitive industry.

FIGURE 11-4

FIGURE 11-4

-Refer to Figure 11-4.Which of the following best describes this industry if all firms have the same cost and revenue curves and are producing output of q0?

Definitions:

Congenital Acetabular Dysplasia

A developmental disorder of the hip joint where the acetabulum is inadequately developed, leading to instability and potential dislocation of the hip.

Comminuted Fracture

A type of bone fracture where the bone is broken into three or more pieces, often requiring surgical intervention for proper healing.

Blowout Fracture

A fracture of the bones surrounding the eye, often caused by blunt trauma.

Depressed Skull

Refers to a portion of the skull that has been pushed inward, often due to trauma.

Q7: With respect to innovation, which of the

Q24: Economists use the notation Q = fL,K)

Q45: Refer to Table 10-2. If the firm

Q57: An oligopolistic firm often detects a change

Q73: In the long run, the law of

Q77: A characteristic of a monopolistically competitive market

Q84: Which of the following producers operate in

Q91: How might a government intervene in a

Q93: Which of the following best explains why

Q109: Refer to Figure 10-6. Assume this pharmaceutical