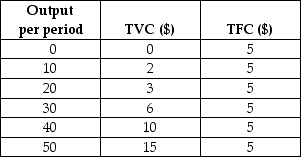

Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens.

TABLE 9-3

TABLE 9-3

-Refer to Table 9-3.Suppose the prevailing market price for this firm's product is $0.14 and the firm is currently producing 20 units of output.This competitive firm wishing to maximize profits would

Definitions:

Expected Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling, as anticipated by consumers, businesses, and policymakers.

Stock Market Declines

Periods when stock prices are falling, leading to a decrease in the value of investment portfolios.

Interest Rates

The cost of borrowing money, expressed as a percentage, charged by a lender to a borrower for the use of funds.

Real Interest Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing and the true yield to the lender or investor, compared to the nominal interest rate.

Q10: Assume you are consuming two goods, X

Q18: Refer to Figure 10-5. Suppose this monopolist

Q45: The deadweight loss of monopoly is<br>A) its

Q47: Consider the following information for a regional

Q54: Refer to Table 7-3. If this firm

Q63: An individualʹs consumer surplus from some product

Q63: Suppose that capital costs $6 per unit

Q95: An imperfectly competitive industry is often allocatively

Q99: Refer to Table 13-1. How many units

Q114: Refer to Figure 12-7. If this firm