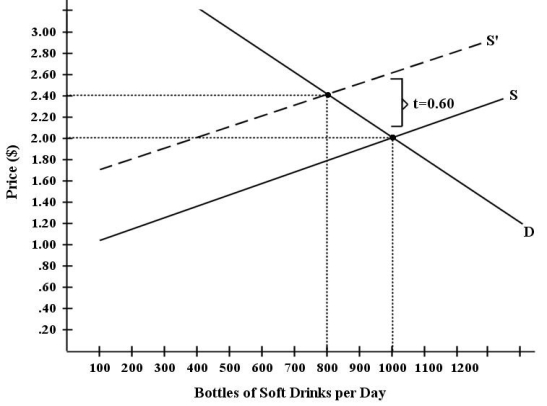

There have been proposals that a tax be imposed on sugar-laden soft drinks in an attempt to reduce their consumption.Assume for simplicity that all bottled soft drinks are the same size.Suppose the initial market equilibrium is P = $2.00 and Q = 1000.  FIGURE 4-4

FIGURE 4-4

-Refer to Figure 4-4.Suppose the government imposes a tax of $0.60 per soft drink purchased.The change in total expenditure on soft drinks is

Definitions:

Value In Use

The value today of the cash flows that are expected to come from an asset or a revenue-producing entity in the future.

Impairment Loss

A reduction in the recoverable value of an asset below its carrying amount on the balance sheet, recognized as a loss.

Recoverable Amount

The higher value between an asset's fair value minus costs of disposal and its value in use.

Carrying Amount

The amount at which an asset or liability is recognized on the balance sheet after deducting any accumulated depreciation, amortization, or impairment.

Q4: Refer to Figure 3-3. At a price

Q25: Given that elasticity of supply changes over

Q47: Refer to Figure 5-4. Suppose the government

Q57: The term ʺcomparative staticsʺ describes the<br>A) analysis

Q58: Refer to Table 7-1. To an accountant,

Q84: Refer to Table 7-5. Given the information

Q90: Refer to Table 4-5. The cross-price elasticity

Q92: Jodi recently went into business producing widgets.

Q98: Refer to Figure 6-3. What is the

Q112: Refer to Figure 6-2. Suppose that the