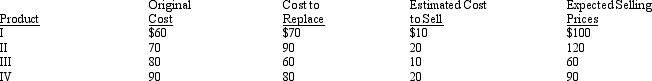

A company sells four products: I, II, III, and IV. The company values all inventories using the lower-of-cost-or-market procedure. The company has consistently experienced a profit margin of 20 percent of sales and expects this rate to hold for the future. Additional information, shown below, is available for the most recent year as of December 31.

See information regarding the four products above. Using the lower-of-cost-or-market procedure, what is the reported inventory value at December 31 for one unit of Product I?

Definitions:

Married Couple

Married Couple refers to two individuals who are legally married to each other and are recognized as a married pair for legal and tax purposes.

Taxable Income

The portion of an individual’s or entity's gross income that is subject to taxes, after accounting for deductions and exemptions.

Dependency Exemption

A tax deduction available to taxpayers for each qualifying dependent, reducing the taxable income. It has been suspended for tax years 2018 through 2025 under the 2017 Tax Cuts and Jobs Act.

Qualifying Child

A dependent who meets specific IRS criteria related to relationship, age, residency, and support, affecting tax benefits.

Q1: Jerry, a college business major, contracts with

Q2: Which of the following events would be

Q14: A person who, although not the legal

Q32: A company sells four products: I, II,

Q34: Chin Chang agreed to buy an antique

Q34: While in the shopping mall, Mabel special

Q44: The changes in account balances of the

Q57: A sale is the same as an

Q64: Cash equivalents would not include short-term investments

Q64: An analysis and aging of the accounts