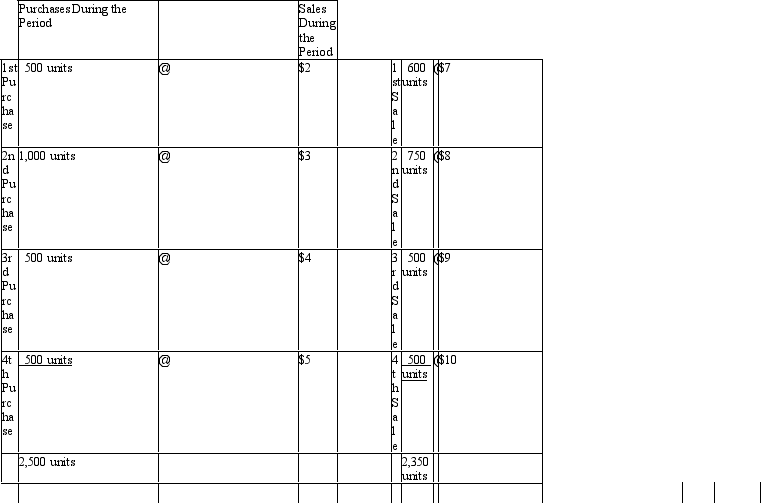

Purchases and sales during a recent period for Coleman, Inc. were:

Beginning inventory was 100 units at $1 each.

See information for Coleman, Inc.above. Given this information, what is the cost per unit available for sale during the year when using the average cost method (rounded to the nearest cent) ?

Definitions:

Deferred Income Taxes

A liability on the balance sheet that results from differences in the timing of recognition of income and expenses for tax and financial reporting purposes.

Straight Line Amortization

A method of allocating the cost of an intangible asset over its useful life in equal annual installments.

Effective Tax Rate

The actual rate at which an individual or a corporation is taxed, calculated by dividing the total tax paid by the taxable income.

Consolidated Balance Sheet

A financial statement showing the combined assets, liabilities, and equity of a parent company and its subsidiaries.

Q4: Which of the inventory cost flow assumptions

Q8: Which of the following is not true?<br>A)

Q10: Several catastrophic accounting failures have occurred over

Q15: Alice Munroe entered into a contract with

Q21: Ralph ordered the installation of a satellite

Q23: Prompt Delivery Ltd. operates a delivery service

Q48: Where the courts have been faced with

Q53: Information from Blain Company's balance sheet is

Q62: A lien is a right of a

Q72: All of the following are a component