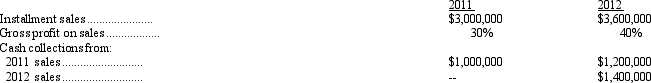

Paral Company began operations on January 2, 2011, and appropriately used the installment sales method of accounting. The following data are available for 2011 and 2012:

The realized gross profit for 2012 is

Definitions:

Beginning Inventory

The value of inventory held by a business at the start of an accounting period.

Inventory Costing Method

Techniques used to assign costs to inventory and cost of goods sold, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

Gross Profit

The financial metric calculated by subtracting the cost of goods sold from net sales, representing the profit from selling goods before deducting operating expenses.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated using a specific inventory valuation method.

Q2: Which of the following events would be

Q12: Munson Fixtures Inc. has contracted with Weibe

Q20: A negotiable instrument is<br>A) valuable documents that

Q25: What is a material alteration in terms,

Q33: The Supreme Court of Canada performs several

Q33: Goods on consignment should be included in

Q37: Cleybourne Company wrote off an $800 uncollectible

Q37: Samson, Inc., presents the following comparative balance

Q38: European Trading Company. converts its foreign subsidiary

Q64: The balance sheet category receivables represents claims