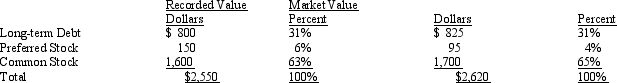

The following summarized information is available for Central Plains Company at December 31 of the current year:

The debt of Central Plains has a before-tax cost rate of 11.5%, preferred stock has a cost of 12.1%, and common equity has a cost of 14.2%. The tax rate for Central Plains is 34%.

Calculate the weighted average cost of capital for Central Plains at December 31 of the current year.

Definitions:

Professional Fields

Various sectors or domains of work that require specialized knowledge and often have specific qualifications or standards.

Employment Section

The part of a website, newspaper, or magazine that lists job openings and opportunities for work.

Résumé

a brief document summarizing an individual's education, work history, and other qualifications for a prospective employer.

Self-Inventory

A process of self-assessment to evaluate one's skills, attributes, and professional interests.

Q24: Assume the following facts for Kurt Company:

Q25: Neptune Company's gross sales in 2011 were

Q32: Which of the following is not a

Q37: The Clayton Music Company was formed on

Q43: Which of the following independent transactions would

Q45: The accounts and balances shown below were

Q51: What is the difference between positive law

Q51: Which of the following is not classified

Q51: Generally, recognition criteria are met and revenues

Q73: Venus Inc. carries Product A in inventory