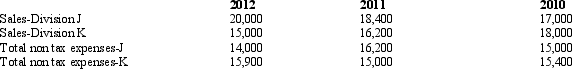

Elwood P. Dowd Company has two divisions, J and K. The operations and cash flows of these two divisions are clearly distinguishable. On July 1, 2012, the company decided to dispose of the assets and liabilities of Division K. It is probable that the disposal will be completed early next year. The revenues and expenses of Dowd Company for 2009 and for the preceding two years are as follows:

During the latter part of 2012, Dowd disposed of a portion of Division K and recognized a pretax loss of $8,000 on the disposal. The income tax rate for Dowd Company is 40%.

Prepare the comparative income statements for Dowd Company for the years 2010, 2011, and 2012.

Definitions:

Inflation Rate

The percentage rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Price Index

A statistical measure that shows changes in the average price level of a selected basket of goods and services over time.

Real Gross Domestic Product

The total value of all goods and services produced within a country in a specific period, adjusted for inflation, indicating the actual growth of an economy.

Intrinsic Value

The actual, fundamental value of an asset, irrespective of its market value, determined through objective calculation or estimation.

Q16: Hall, Inc., enters into a call option

Q21: A company enters into a futures contract

Q36: Crescent Corporation's interest revenue for 2011 was

Q38: Which of the following is true?<br>A) Cash

Q59: Which of the following is not a

Q64: A contingent loss should be disclosed in

Q66: A firm using the perpetual inventory method

Q67: Miller Inc. is a wholesaler of office

Q79: The allowance for doubtful accounts, which appears

Q88: If goods shipped FOB destination are in