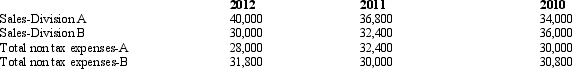

Huntington Company has two divisions, A and B. The operations and cash flows of these two divisions are clearly distinguishable. On July 1, 2012, the company decided to dispose of the assets and liabilities of Division B. It is probable that the disposal will be completed early next year. The revenues and expenses of Huntington Company for 2012 and for the preceding two years are as follows:

During the latter part of 2012, Huntington disposed of a portion of Division B and recognized a pretax loss of $10,000 on the disposal. The income tax rate for Huntington Company is 40%.

Prepare the comparative income statements for Huntington Company for the years 2010, 2011, and 2012.

Definitions:

Net Operating Income

The profit generated from a company's regular business operations, excluding expenses and revenues from non-operating activities.

Monthly Sales

Monthly sales represent the total revenue or units sold by a business within a calendar month, often used to gauge performance and trends.

Operating Leverage

A measure of the proportion of fixed costs in a company's cost structure, indicating how a change in sales volume will affect operating income.

Cedar Shingles

Thin, tapered pieces of cedar wood used as durable roofing materials.

Q18: Gordon Company's inventory at June 30, 2011,

Q19: Which of the following types of errors

Q21: Statement of Financial Accounting Concepts No. 1,

Q27: Which of the following is consistent with

Q48: A truck owned and operated by Abbott

Q50: The following information has been collected regarding

Q52: Cameron Co. began operations on January 1,

Q56: Which of the following would not be

Q58: Bank reconciliations are normally prepared on a

Q81: Richards Company uses the allowance method of