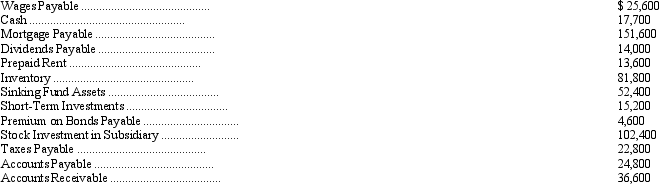

The accounts and balances shown below were gathered from Paynter Corporation's trial balance on December 31, 2011. All adjusting entries have been made.

See information for Paynter Corporation above. The amount that should be reported as current liabilities on Paynter Corporation's balance sheet is

Definitions:

LIFO-to-FIFO Adjustment

A recalculation process that converts inventory valuation from the Last-In-First-Out (LIFO) method to the First-In-First-Out (FIFO) method, affecting cost of goods sold and inventory value.

Inventory

The total amount of goods and materials held by a company that are available for sale or production.

LIFO

Last In, First Out is a method of valuing inventory in which items that are produced last are sold before those that are produced earlier.

FIFO Cost

First-In, First-Out cost method; an inventory valuation strategy where the costs of the earliest goods purchased are the first to be recognized in cost of goods sold.

Q14: A firm's accumulated depreciation account increased $30,000

Q16: Partial balance sheet data and additional information

Q20: The following balances have been excerpted from

Q29: Adlake Corporation provides the following account balances

Q37: Cleybourne Company wrote off an $800 uncollectible

Q44: The changes in account balances of the

Q54: The following information is available from Ram

Q62: The information listed below was obtained from

Q82: When valuing raw materials inventory at lower

Q111: Ami Retailers purchased merchandise with a list