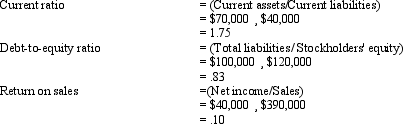

The following 3 ratios have been computed using the financial statements for the year ended December 31, 2011, for James Company:

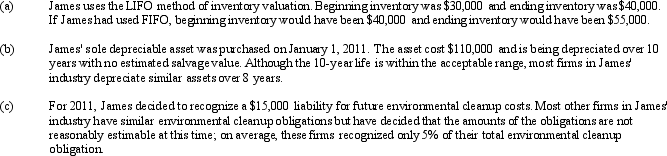

The following additional information has been assembled:

Show how the values for the 3 ratios computed above differ if James had used FIFO, depreciated the asset over 8 years, and recognized only 5% of its environmental cleanup obligation. Compute how the financial statements would differ if the alternative accounting methods had been used. Do not treat the use of these alternative methods as accounting changes. Ignore any income tax effects.

Definitions:

Advance Payment

Payment made before its due date, often required in contracts as a form of security or commitment.

Legal Fees

The charges or payments made to lawyers for their professional services, which can include hourly rates, flat fees, or contingent fees.

Retainer

An advance payment made by a client to a law firm to cover part of the legal fees and/or costs that will be incurred on that client’s behalf.

Keeping Clients Informed

The responsibility of lawyers to regularly update and communicate with their clients about the status and developments in their legal matters.

Q2: The following information has been collected for

Q32: The amount of income reported for tax

Q39: The gross margin method is a method

Q44: Which of the following is incorrect?<br>A) The

Q51: On May 17, it was discovered that

Q60: Which of the following is characteristic of

Q70: When preparing a statement of cash flows

Q71: The importance of revenue to a business

Q81: Yeager Company incurred the following infrequent losses

Q121: The following information was available from the