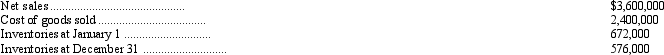

Selected information from the accounting records of Ellison Manufacturing follows:

What is the number of days' sales in average inventories for the year?

Definitions:

Income Tax Expense

The amount of income taxes a company expects to pay for the current tax year, accounting for deferred taxes.

Book Income Before Income Tax

The income that a company reports on its financial statements before the deduction of income tax expenses.

Tax Depreciation

The depreciation expense allowed by tax authorities to account for the reduction in value of a tangible asset over its useful life, intended to provide a tax shield for businesses.

Book Depreciation

The portion of an asset's initial cost that is allocated as an expense over its useful life on the financial statements, according to accounting standards.

Q18: Which of the following is a counterbalancing

Q19: On September 1, 2010, Star Corp. issued

Q21: The completed-contract method of accounting for long-term

Q22: Which of the following best describes contributed

Q24: Assume the following facts for Kurt Company:

Q53: Johnson's Distributing purchased equipment on January 1,

Q55: Berman Corporation had the following transactions in

Q87: Montague Company reported the following balances:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7844/.jpg"

Q94: Beginning and ending Accounts Receivable balances were

Q121: The following information was available from the