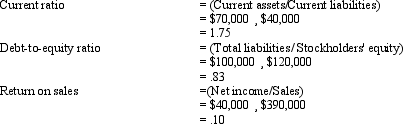

The following 3 ratios have been computed using the financial statements for the year ended December 31, 2011, for James Company:

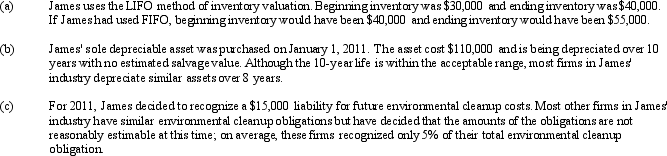

The following additional information has been assembled:

Show how the values for the 3 ratios computed above differ if James had used FIFO, depreciated the asset over 8 years, and recognized only 5% of its environmental cleanup obligation. Compute how the financial statements would differ if the alternative accounting methods had been used. Do not treat the use of these alternative methods as accounting changes. Ignore any income tax effects.

Definitions:

Weighted Average Cost of Capital

A calculation of a company's cost of capital in which each category of capital is proportionately weighted, used to evaluate the cost of funding projects.

Bond Issue

The process by which a company or government raises funds by selling bonds to investors, which then are obliged to pay back with interest.

Cost of Equity

The return a company theoretically pays to its equity investors, i.e., shareholders, to compensate for the risk they undertake by investing their capital.

Annual Dividend

The total dividend payment a company makes to its shareholders in a single year.

Q2: Which of the following events would be

Q16: Which of the following errors will be

Q17: Under international accounting standards, if a sale-leaseback

Q17: In preparing a statement of cash flows,

Q30: Brooke Company began operations on January 1,

Q48: During 2011, Franklin Company reported revenues on

Q55: Which of the following items is usually

Q70: Which of the following is presented in

Q72: All of the following are a component

Q80: Statement of Financial Accounting Concepts No. 1