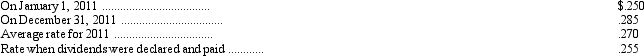

Albright Distributing Inc. converts its foreign subsidiary financial statements using the translation process. Their German subsidiary reported the following for 2011: revenues and expenses of 10,050,000 and 7,800,000 marks, respectively, earned or incurred evenly throughout the year, dividends of 2,000,000 marks were paid during the year. The following exchange rates are available:

Translated net income for 2011 is

Definitions:

Absorption Costing

Absorption Costing is an accounting method that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Unit Product Cost

The total cost (both fixed and variable) associated with a product, divided by the number of units produced.

Year 2

Often refers to the second year of operation, study, or analysis in various contexts, particularly in financial and academic settings.

Absorption Costing

A technique in financial accounting that involves accumulating all costs of production, namely direct materials, direct labor, and overhead (both fixed and variable), into the cost base of a product.

Q4: Alpha Company purchases a call option to

Q6: In preparing a bank reconciliation, interest paid

Q33: Which of the following is the current

Q34: The accountant for the Goshen Company assembled

Q36: Cosmo Company is expected to pay a

Q65: Effective January 2, 2011, Kincaid Co. adopted

Q78: A contingency must be accrued in the

Q79: In a statement of cash flows prepared

Q80: Which of the following is not acceptable

Q80: Statement of Financial Accounting Concepts No. 1