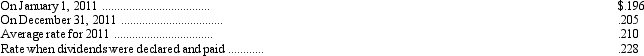

Maxim Importing Company. converts its foreign subsidiary financial statements using the translation process. The company's French subsidiary reported the following for 2011: revenues and expenses of 10,500,000 and 6,505,000 francs, respectively, earned or incurred evenly throughout the year, dividends of 500,000 francs were paid during the year. The following exchange rates are available:

Translated net income for 2011 is

Definitions:

Noncontrolling Interest

A stake in a company owned by minority shareholders that doesn’t give them control over the company's operational and financial decisions.

Noncontrolling Interest

A minority share in a subsidiary that is not enough to exert control, often reflected in the parent company's financial statements as part of equity but separate from the parent's equity.

Consolidated Balance Sheet

A financial statement that combines all the assets, liabilities, and equity of a parent company and its subsidiaries into one document.

Acquisition

The process by which one company purchases most or all of another company's shares to gain control of that company.

Q2: The following information has been collected for

Q3: Which of the following is typically associated

Q8: What is the correct treatment of a

Q10: On July 1, 2011, Cahoon Company sold

Q28: Financial statement elements relating to income are

Q33: The calculation of a reportable segment's operating

Q35: Which of the following statements regarding international

Q35: The changes in the account balances and

Q51: FASB Statement No. 132R requires that the

Q59: Grover, Inc., appropriately uses the installment sales