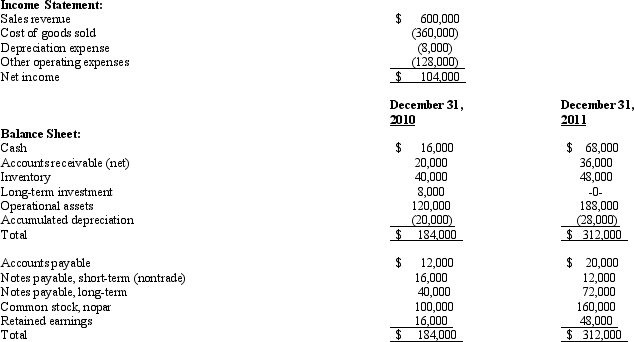

The records of George Company provided the following information for the year ended December 31, 2011:

Additional Information:

1. Sold the long-term investment at cost, for cash. The securities were classified as available-for-sale. The market value had not changed since acquisition.

2. Declared and paid a cash dividend of $28,000.

3. Purchased operational assets that cost $68,000 by giving a $48,000 long-term note payable and by paying $20,000 cash.

4. Paid a $16,000 long-term note payable by issuing common stock having a market value of $16,000.

5. Issued a stock dividend of $44,000.

Required:

Prepare a statement of cash flows using the direct method for George Company for the year ending December 31, 2011.

Definitions:

Divest

To sell off assets, investments, or divisions of a company as a strategic move to focus on core operations or for other financial reasons.

Functional Level

The operational layer in an organization where specific, routine tasks are carried out, often correlating with departments like sales or HR.

Specialists

Experts or professionals with a deep understanding and knowledge in a specific field or area, often hired to address particular challenges within a business.

Strategic Planners

Professionals responsible for developing and implementing long-term goals and strategies to ensure a company's growth and success.

Q4: In relation to a set of 2012

Q11: The purpose of an interperiod income tax

Q25: Which of the following accounting treatments is

Q39: On a statement of cash flows prepared

Q39: On December 27, 2011, Johnson Company ordered

Q39: Accounts receivable usually are factored<br>A) with recourse

Q44: SFAS No. 109 uses the term "tax-planning

Q44: For a company with a periodic inventory

Q54: Which of the following transactions would not

Q80: Statement of Financial Accounting Concepts No. 1