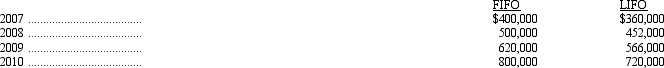

On January 1, 2011, Wiley Corporation changed its inventory cost flow assumption from FIFO to LIFO. The change was made for financial statement and tax reporting. Wiley's inventory values at the end of each year since inception under both methods are summarized below.

Ignoring income taxes, what is the amount of adjustment required in the 2011 accounts, and where would it be reported in the financial statement?

Definitions:

Employment

A formal relationship between an employer and an employee in which work is performed in exchange for compensation.

Restrictive Covenants

Clauses in a contract that impose restrictions on one or more parties' actions, commonly used in employment and real estate agreements.

Anton Piller Order

A court order that permits the plaintiff to search premises and seize evidence without prior warning, to prevent the destruction of relevant documents or items.

Workers' Compensation

A form of insurance providing wage replacement and medical benefits to employees injured in the course of employment.

Q3: At December 31, 2010, Benjamin Company had

Q37: The last step in the accounting cycle

Q47: Which of the following arguments is supportive

Q48: During 2011, Franklin Company reported revenues on

Q49: Supplemental disclosures required only when the statement

Q54: Teller Inc. reported an allowance for doubtful

Q66: Barker, Inc. receives subscription payments for annual

Q71: Perfect Technologies has estimated bad debts using

Q71: At the end of the current fiscal

Q72: Frye Company uses the direct method to