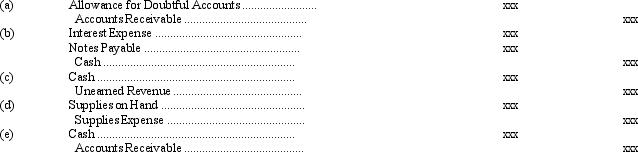

For each of the journal entries below, write a description of the underlying event. Assume that for prepaid expenses original debits are made to an expense account.

Definitions:

Payroll Bank Account

A specific bank account designated for processing payroll and related transactions for a company's employees.

Reconciliation Functions

The process of ensuring that two sets of records (usually the balances of two accounts) are in agreement, to ensure accuracy and consistency in financial accounts.

Federal Unemployment Compensation Taxes

Taxes imposed on employers to fund unemployment benefits for workers who have lost their jobs.

Medicare Taxes

Taxes deducted from paychecks to fund the Medicare program, which provides health insurance to individuals over 65 or with certain disabilities.

Q6: Which of the following is not considered

Q7: The reported identifiable assets of a reportable

Q16: Which of the following is an example

Q17: Selected information from the 2011 and 2010

Q25: The following errors were made in preparing

Q39: The following information relates to the defined

Q58: Recognizing tax benefits in a loss year

Q59: Pretax accounting income is $100,000 and the

Q62: Which of the following would not be

Q86: The entry to record the issuance of