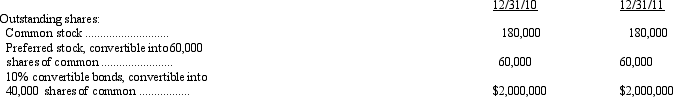

The following information relates to the capital structure of Metcalf Corp.:

During 2011 Metcalf paid $90,000 in dividends on the preferred stock. Metcalf's net income for 2011 was $1,960,000 and the income tax rate was 40 percent. For the year ended December 31, 2011, the diluted earnings per share is

Definitions:

Q5: Assume cash paid to suppliers for 2011

Q5: Which of the following statements characterizes defined

Q21: FASB Statement No. 87 states that prior

Q23: From the following, select the most appropriate

Q25: The following 3 ratios have been computed

Q34: Which type of contract is unique in

Q38: When enacted tax rates change, the asset

Q44: On June 30, a company paid $3,600

Q56: Which of the following would not be

Q60: An eight-year capital lease specifies equal minimum