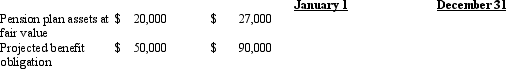

Records for the Carp Corporation's defined-benefit pension plan show a net unrecognized loss at December 31, 2010, of $30,000, after recording the pension expense for 2010. The average expected service period of the company's employees is 10 years. The actuary notifies Carp's management that an actuarial gain of $4,000 is determined at January 1, 2011. Actual return for 2011 is $2,000, and expected return is $3,000. The following information also is available for the 2011:

The minimum amortization of unrecognized loss increases 2011 pension expense by what amount?

Definitions:

Coupon Rates

The interest rate stated on a bond when it's issued, which determines the interest payments the bond issuer will make to the bondholder.

Interest Rates

The cost of borrowing money, typically expressed as a percentage of the principal, paid by the borrower to the lender.

Zero-Coupon Bond

A type of bond that does not make periodic interest payments but is issued at a discount to its face value and pays its face value at maturity.

Deep Discount Bond

A bond that sells at a significantly lower price than its par value, often due to high interest rates or the poor credit rating of the issuer.

Q4: Johntech Inc. leased a new machine having

Q7: A company changes from an accounting principle

Q11: The sum-of-the-years'-digits method of depreciation is being

Q11: On December 31, 2011, Prince Company appropriately

Q20: The sale of a depreciable asset resulting

Q27: Under international accounting standards, cash paid for

Q36: Which of the following is most likely

Q37: Albright Distributing Inc. converts its foreign subsidiary

Q51: A deferred tax liability arising from the

Q100: On January 1, 2011, Williams Company lent