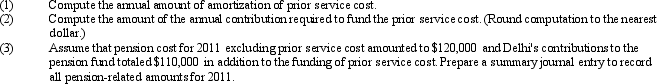

On January 1, 2011, the Delhi Corp. amended its defined benefit pension plan to provide increased retirement benefits for its 150 employees covered by the plan on that date. As a result of the plan amendment, the projected benefit obligation as of January 1, 2011, increased by $1,275,000. Management decided to amortize this amount on a straight-line basis over the average remaining service life of the 150 employees. It is assumed that employees will retire at the rate of six employees per year over the next 25 years. The prior service cost is to be funded with equal annual contributions over a ten-year period. The first contribution is due at the end of 2011 and the assumed interest rate for funding purposes is 12 percent. The present value factor for an ordinary annuity for ten periods at 12 percent is 5.6502.

Definitions:

Q3: Which of the following statements concerning guaranteed

Q5: Which of the following creates a permanent

Q10: Rome Enterprises, a subsidiary of La Italia

Q12: On January 1, 2010, Bartley Company initiated

Q23: From the following, select the most appropriate

Q25: Summers, Inc., pays its managers a bonus

Q29: Which one of the following items is

Q37: Cohen Corporation owns 1,000 shares of common

Q43: When an investor uses the cost method

Q45: Which of the following is not required