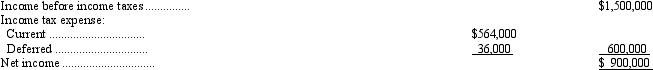

The following information was taken from Buccaneer Corporation's 2011 income statement:

Buccaneers' first year of operations was 2011. The company has a 30 percent tax rate. Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes. The amount charged to depreciation expense in 2011 was $600,000. Assuming no other differences existed between book income and taxable income, what amount did Buccaneer deduct for depreciation on its tax return for 2011?

Definitions:

Simple Linear Regression

A statistical method that shows or predicts the relationship between two continuous variables, using a straight line to describe the linear relationship.

Correlation Coefficient

A statistical measure that calculates the strength and direction of a linear relationship between two quantitative variables.

Residuals

Differences between observed values and the estimated values in a statistical model, reflecting the amount of unexplained variance in the model.

Fitted Values

Estimated values predicted by a regression model, based on the observed data.

Q10: For which type of investments would unrealized

Q13: Intraperiod tax allocation<br>A) involves the allocation of

Q18: Which of the following is a counterbalancing

Q27: Which of the following is consistent with

Q33: The calculation of a reportable segment's operating

Q36: Tyler Company began operations in 2010. The

Q55: Ryan Company purchased a machine on July

Q62: The information listed below was obtained from

Q62: Franklin Corporation had 100 shares of common

Q63: Which of the following is true of