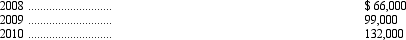

Dodger Corporation reported a loss for both financial reporting purposes and tax reporting purposes of $231,000 in 2011. For financial reporting purposes, Dodger reported income before taxes for years 2008-2010 as listed below:

Assuming Dodger's tax rate is 30 percent in all periods, and that the company uses the carryback provisions, what amount should appear in Dodger's statements for financial reporting purposes as a net loss in 2011?

Definitions:

Depressants

Substances that reduce neurological activity and produce a calming effect, often used to treat anxiety or sleep disorders.

Anxiety

A state of distress or agitation over an outcome that is not assured.

Conscious

Being aware of and responsive to one's surroundings; awake.

Waking State

A state of consciousness where an individual is fully awake and aware of their environment.

Q12: Ignoring income taxes, choose the correct response

Q21: At December 31, 2011, Jenkins Sales &

Q21: Which of the following depreciation methods applies

Q33: Blaine Inc. shows the following data relating

Q45: Using the information below, compute the gain

Q52: Which of the following liabilities is not

Q52: In 2010, Silverspur Mining Inc. purchased land

Q54: On December 31, 2010, Superior, Inc. had

Q61: On December 31, 2011, Cooke Company leased

Q78: EB Company reports its income from its