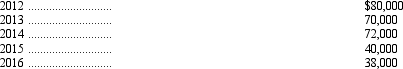

Analysis of the assets and liabilities of Marie Corp. on December 31, 2011, disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000. There was no difference in the liability basis. The difference in asset basis arose from temporary differences that would reverse in the following years:

The enacted tax rates are 30 percent for the years 2011-2014 and 35 percent for 2015-2018. The total deferred tax liability on December 31, 2011, should be

Definitions:

Induction

A reasoning method that makes generalizations based on observations, moving from specific instances to broader generalizations.

Scheffé Test

A statistical post-hoc test used to compare multiple group means simultaneously after an ANOVA to control the type I error rate.

Tukey Test

Statistical procedure used to control familywise error when conducting all possible simple comparisons between groups.

Simple Comparisons

Analytical comparisons between two groups.

Q1: Which of the following causes a change

Q7: An example of an adjusting entry involving

Q35: Arctic Ice Inc. compensates its employees for

Q48: On January 1, 2008, Grayson Company purchased

Q48: The following balances have been excerpted from

Q55: Which of the following intangible assets does

Q64: On July 1, 2011, Mountain Systems acquired

Q68: Joseph Company acquired a tract of land

Q78: In order for a lease to be

Q103: At December 31, 2011, Reed Corp. owed