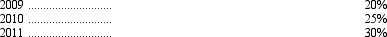

For three consecutive years, 2009-2011, Twins Corporation has reported income before taxes of $100,000 for both financial reporting purposes and tax reporting purposes. During this time, Twins income tax rates were as follows:

In 2012, Twins' tax rate changed to 35 percent. Also in 2012, the company reported a loss for both financial reporting and tax reporting purposes of $100,000. Assuming the company uses the carryback provisions, the amount Twins' should report as an income tax refund receivable in 2012 is

Definitions:

Distribution System

A network through which a company supplies its products or services to its customers.

Ruling Class

The social class that holds the majority of wealth, power, and influence within a society, often making and enforcing policies and decisions.

Elite Groups

A small, select group of people within society who hold a disproportionate amount of wealth, privilege, political power, or skill.

Terrorism

The use of violence and intimidation, especially against civilians, in the pursuit of political aims.

Q7: A truck that cost $8,000 was originally

Q21: On July 1, 2011, Hawkeye Aviation leased

Q26: On January 1, 2011, Shak, Inc. signed

Q46: Which of the following neednot be disclosed

Q46: Failure to record depreciation expense at the

Q49: Potter Corporation leased used equipment to Weasley,

Q52: A lease contains a bargain purchase option.

Q64: On July 1, 2011, Mountain Systems acquired

Q74: For the current year, Northern Pacific Company

Q81: Scott Co. reported an allowance for doubtful